Paytm Share Price Analysis: Navigating Market Volatility

financial health of Paytm is very poor now –

Paytm, one of India’s leading digital payment platforms, has been experiencing significant fluctuations in its share price recently. As of the latest update, Paytm’s share price closed at ₹438.35, reflecting a notable decrease of 10% from yesterday’s closing price of ₹487.05. In this article, we will delve into the factors influencing Paytm’s share price movement, the impact of recent market trends, and the company’s overall financial health.

Financial Health of Paytm Amidst Turbulence:

To comprehend Paytm’s share price fluctuations, it is imperative to consider the broader market dynamics and global economic factors. The stock market is inherently volatile, influenced by a myriad of elements ranging from economic indicators to geopolitical events. In recent times, global economic uncertainties, trade tensions, and the ongoing COVID-19 pandemic have created an environment where investors are more sensitive to market changes. then down the financial health of Paytm.

Paytm, being a prominent player in the fintech sector, is not immune to these external factors. Changes in global economic conditions and investor sentiment can significantly affect the company’s stock performance. As a result, it is crucial for investors to remain vigilant and adapt their strategies accordingly.

Company-Specific Factors : PAYTM IMPACT

While external factors play a role, company-specific factors also contribute to Paytm’s share price movements. Investors closely monitor key financial metrics, business strategies, and competitive positioning to assess a company’s overall health. now financial health of paytm show negative sentiment.

Paytm has diversified its offerings beyond digital payments, expanding into areas such as financial services, e-commerce, and digital banking. While this diversification can provide new revenue streams, it also exposes the company to challenges in managing multiple business verticals. Investors are likely scrutinizing Paytm’s ability to effectively navigate this diversification and capitalize on emerging opportunities.

Financial health of PAYTM.

Examining Paytm’s financial performance is integral to understanding its share price movements. Investors typically scrutinize key financial metrics such as revenue growth, profitability, and cash flow. Any deviations from expectations in these areas can trigger reactions in the stock market.

It is essential to analyze Paytm’s financial statements, including income statements, balance sheets, and cash flow statements, to gauge the company’s financial health. This comprehensive evaluation helps investors make informed decisions and anticipate potential market movements.

The fintech sector is fiercely competitive, with numerous players vying for market share. Paytm faces competition from both traditional financial institutions and emerging fintech startups. Changes in market dynamics, including the entry of new competitors or shifts in consumer preferences, can impact Paytm’s position in the industry.

Investors closely monitor the company’s ability to innovate, adapt to market trends, and maintain a competitive edge. Evaluating Paytm’s market share, customer acquisition strategies, and partnerships can provide insights into its long-term prospects and influence share prices.

Regulatory Environment:

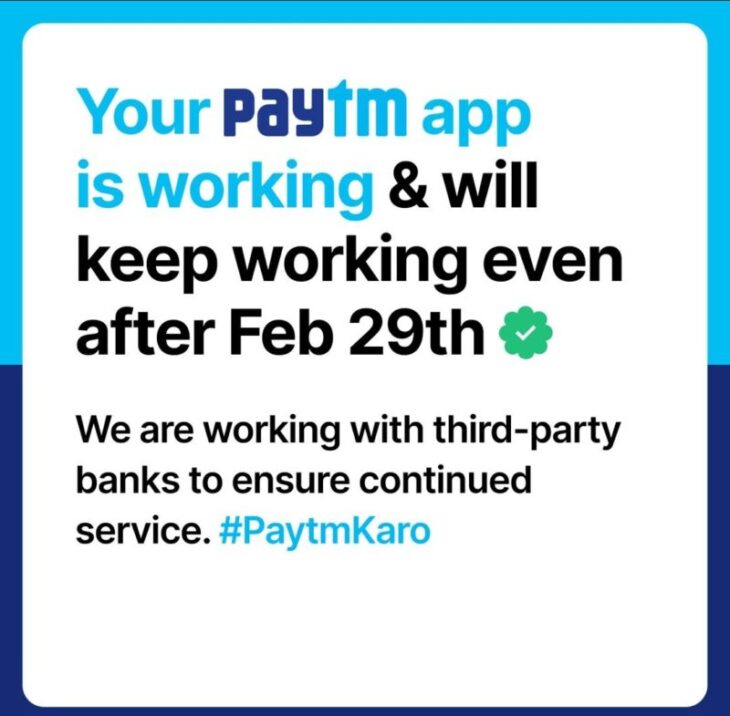

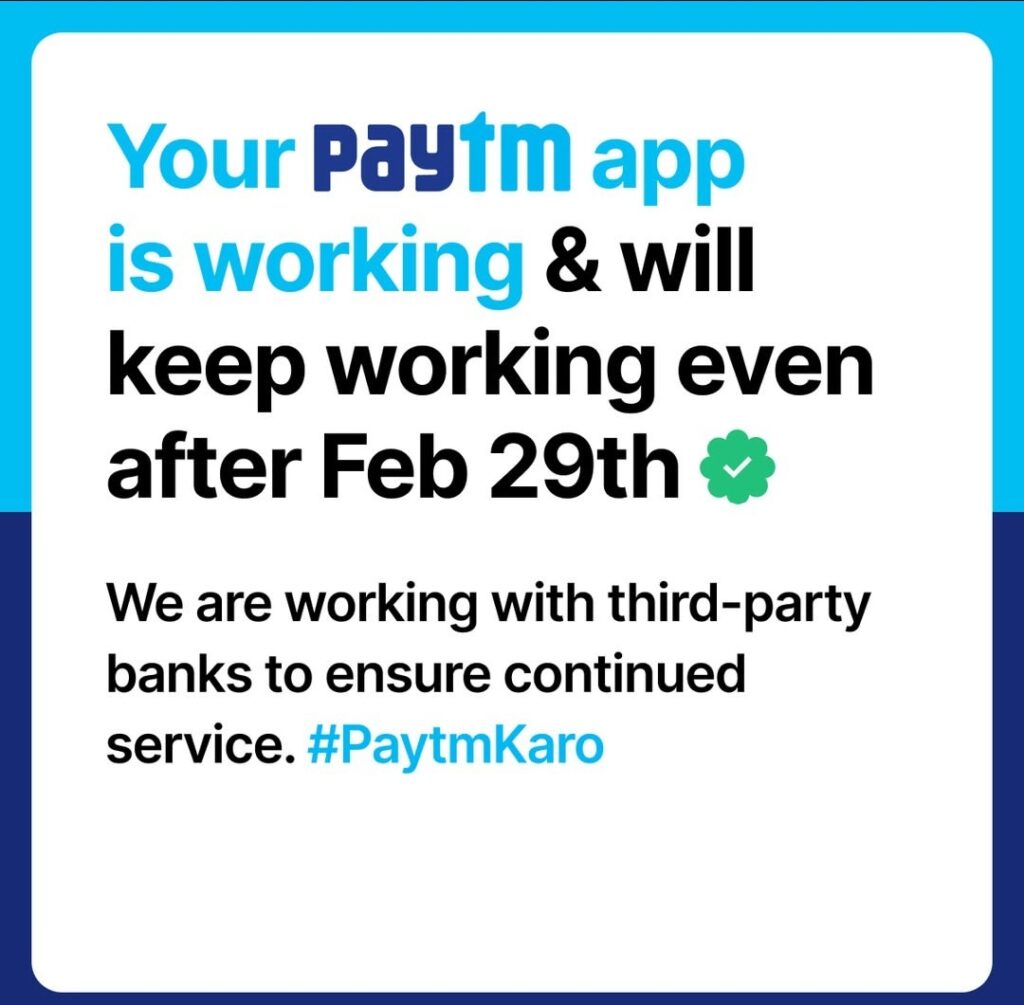

The regulatory environment significantly influences the operations of fintech companies like Paytm. Changes in regulations, licensing requirements, or government policies can have a direct impact on the company’s business operations and, consequently, its share price.

Investors should stay informed about regulatory developments in the fintech sector, as these can create both challenges and opportunities for companies like Paytm. A proactive approach to compliance and a solid understanding of regulatory dynamics are crucial for sustaining long-term growth.

Investor Sentiment and Perception:

The sentiment and perception of investors also play a pivotal role in shaping Paytm’s share price. News, rumors, and market speculation can trigger rapid shifts in investor sentiment, leading to volatile stock movements. financial health of Paytm overall down.

Paytm’s management must actively engage with investors, providing transparent communication and updates on the company’s performance and strategic initiatives. Open and clear communication helps build trust and confidence among investors, potentially mitigating the impact of negative market sentiment. Investor sentiment Paytm bad. Financial Health of Paytm Amidst Turbulence:

Investors should approach the current market situation with a holistic perspective, considering both external and internal factors. Paytm’s ability to navigate challenges, capitalize on opportunities, and maintain transparency with investors will play a crucial role in determining its future stock performance.

As the market continues to evolve, staying informed and adapting investment strategies accordingly is essential for investors looking to navigate the complexities of the fintech sector.

In conclusion, Paytm’s recent share price decline to ₹438.35, down 10% from the previous day’s close, warrants a comprehensive analysis of various factors. Global economic conditions, company-specific dynamics, financial performance, competition, regulatory environment, and investor sentiment collectively contribute to the stock’s volatility.