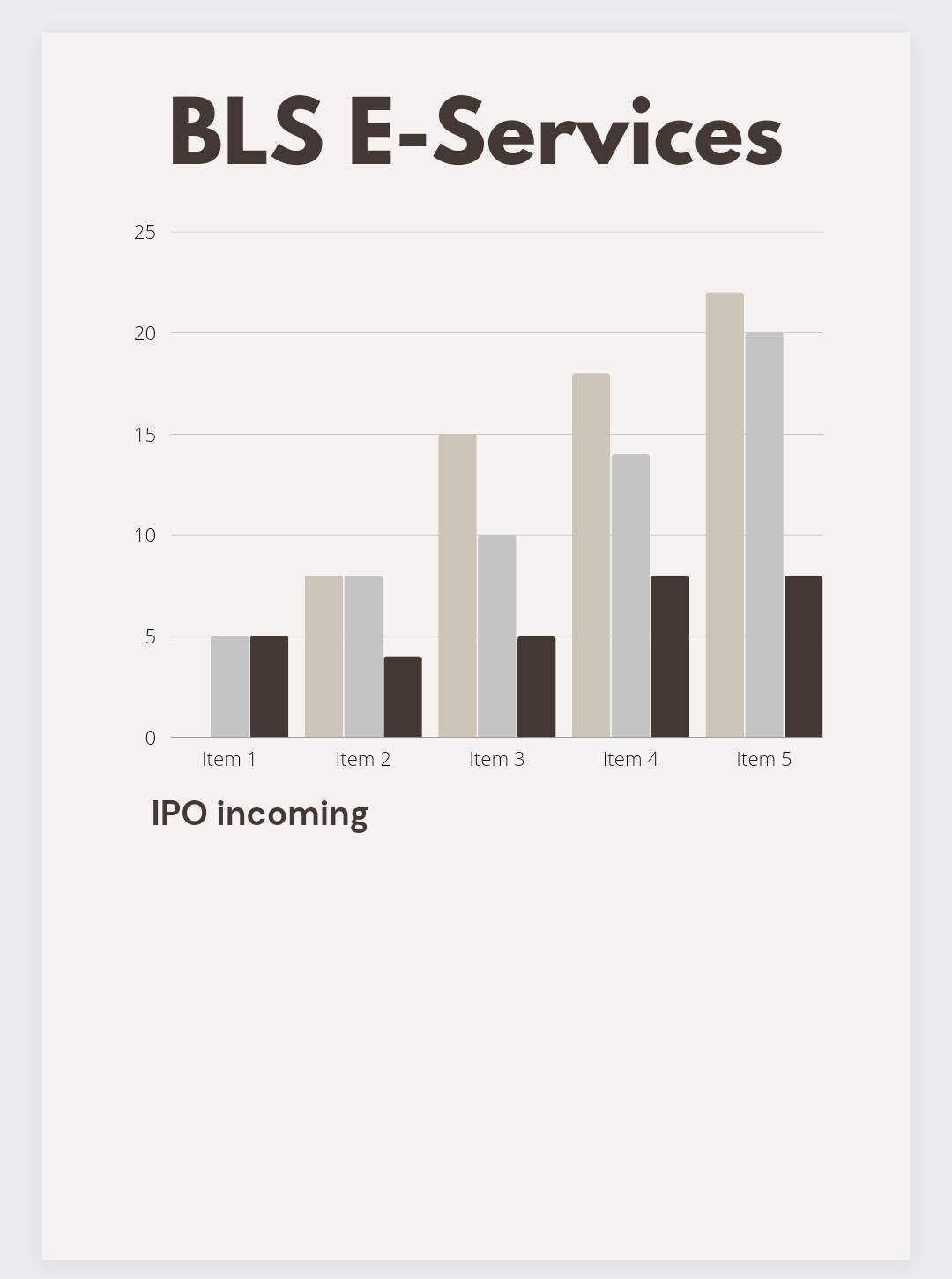

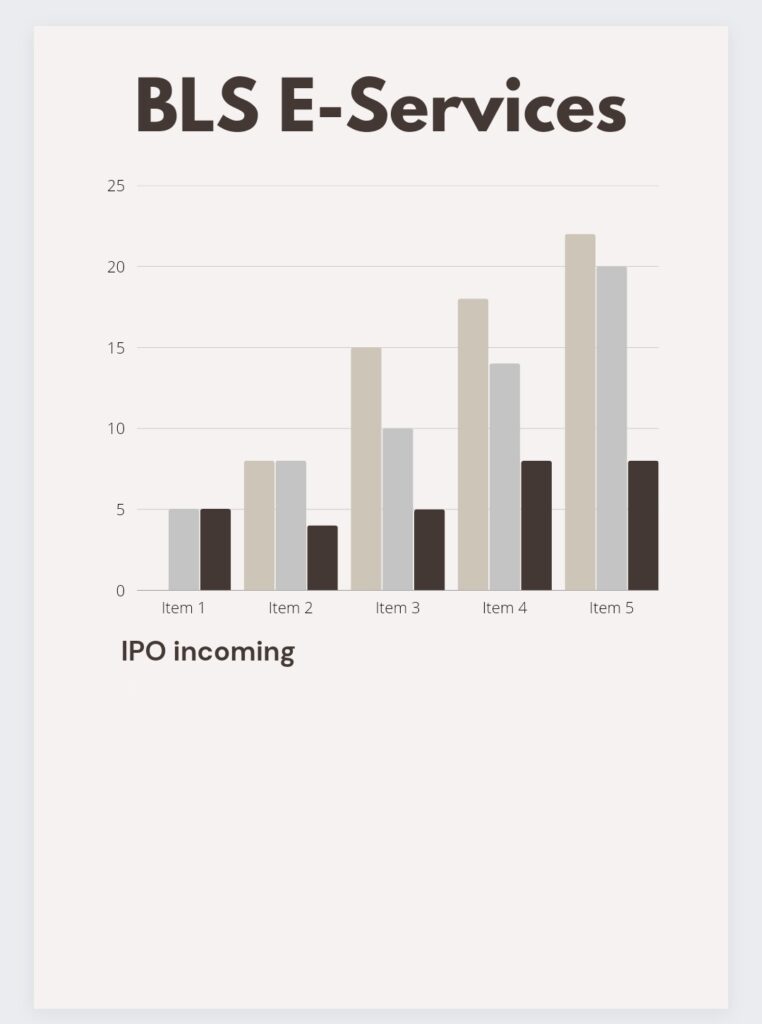

BLS E-Services( IPO allotment ) -:

BLS E-Services uses a tech-enabled model to deliver digital services in G2C, B2C, and B2B sectors. It was incorporated in April 2016 and is a subsidiary of BLS International Services, which provides visa and passport processing services.

BLS E-Services is likely to finalize the basis of allotment for its recent IPO on Friday, 2Feb 2024. Bidders are likely to receive messages, alerts or emails regarding debit of funds or revocations of IPO mandate over the extended weekend or latest by Monday, February 05 2024.

BLS E-Services Limited IPO price band has been fixed in the range of ₹129 to ₹134 per equity share of the face value of ₹10.

BLS E-Services IPO lot size is 108 equity shares and in multiples of 108 equity shares thereafter.it showing BLS E-Services limited .

BLS E-Services IPO = fresh issue of shares around 2,30,30,000 crore equity shares by the subsidiary of the listed business BLS International Services.

GMP market -: (grey market premium)

BLS E-Services has seen going up the bidding for the issue. Last heard, the company was order a premium of Rs 175.5 per share, suggesting a listing pop of about 130% for the investors. However, it was around Rs154-160 price point , when the issue was opened for bidding.

Incorporated in April 2016, BLS-E Services is a digital service provider that offers business correspondence services to major banks in India, assisted E-Services, and E-Governance services at the lower level in India. They are the three key categories services available country. recharge bill Bill Payment, Micro atm, Aadhaar pay, Money transfer and many more. in lower level to higher level in India.

Brokerage were positive and issue it. suggested subscribing to bls e-service citing its strong-and good financial performance. BLS E-service used asset light model, deep rooted network in the pan-India market. BLs E-services (rich valuations and rising competition)were seen as the major drawbacks for the listed IPO.

LISTING DATE -:

February/ 06 /2024 BLS E-Service shares are listing in BSE & NSE in India.

Investor apply and check the IPO in your brokage site or (BSE) website.

| IPO Date | Jan 30, 2024 to Feb 1, 2024 |

| Listing Date | [.] |

| Face Value | ₹10 per share |

| Price Band | ₹129 to ₹135 per share |

| Lot Size | 108 Shares |

| Total Issue Size | 23,030,000 shares (aggregating up to ₹310.91 Cr) |

| Fresh Issue | 23,030,000 shares (aggregating up to ₹310.91 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| Share holding pre issue | 66,726,485 |

| Share holding post issue | 89,756,485 |

Disclaimer: The information provided on our platform is not intended as financial advice. only educational and informational purposes only ,Users are encouraged to consult with a qualified financial advisor or professional before making any investment decisions.

The Information provided on, from or through this website is general in nature and is solely for educational purposes. The market recommendation Investing in the stock market involves risks, and past performance is not indicative of future results. The value of investments can go up or down, and investors may lose money. It is essential to conduct thorough research and seek advice from qualified financial professionals before making investment decisions.